Providing useful insights and making the complex world of energy more accessible, from an experienced industry professional. A service of GSW Strategy Group, LLC.

Thursday, October 29, 2009

Counting All the Carbon

When the emailed table of contents for the October 23 issue of Science showed up in my inbox last Friday, I spotted the name of Timothy Searchinger of Princeton University as lead author of the paper cited by the Journal today. Dr. Searchinger was also the lead author of an earlier paper in Science that I highlighted last February, when the debate concerning the global land-use implications of corn ethanol was just getting underway. Dr. Searchinger's collaborators on the new paper are an impressive bunch, including Dr. Dan Kammen, the director of the Renewable and Appropriate Energy Laboratory at U.C. Berkeley.

The report provides further evidence that it's no longer appropriate to assume that just because the carbon embodied in biofuels such as ethanol originated in green plants that absorbed it from the atmosphere, they must therefore be "carbon neutral"--other than the emissions from fossil fuels used in the cultivation, harvesting and transportation of the crops from which they are produced, along with the energy used in their processing. Additional emissions apparently result from the global displacement of the crops turned into energy here, and in some cases those emissions are on a similar order of magnitude to the direct emissions from the combustion of the biofuels--combustion that has gotten a free pass until now.

This is a highly inconvenient result for those engaged in the production of biofuels from food crops, on two levels. First, it puts the climate change justification for the subsidies and mandates responsible for the rapid ramp-up of conventional biofuel production in question. Second, the source of this doubt is no less than one of the same scientific journals in which so much of the peer-reviewed science contributing to the oft-cited scientific consensus on climate change has appeared, and subject to the same level of scientific scrutiny. Casting doubt on the source of this unwelcome message thus risks casting doubt on the entire edifice upon which the current, much-expanded biofuel endeavor rests.

Let's be clear that I don't blame the biofuel industry for promoting a product that many thought would help, but may ultimately turn out to do little or nothing to reduce the greenhouse gas emissions implicated in climate change, any more than we should blame the producers and consumers of fossil fuels for their contribution to the accumulation of those gases before the current consensus on climate change emerged. (I confess that I regard attempts to portray that consensus as having existed as long as 40 years ago as the worst kind of revisionism, since the creation of the consensus depended not on a few key insights, which might have turned out to be wrong, but on mounting evidence from the steady accumulation of peer-reviewed research during that interval.)

Having said that, I have a much harder time understanding the inclusion of an equally serious--and apparently entirely conscious--omission in the new automotive fuel economy and emissions standards jointly developed by the Environmental Protection Agency and the Department of Transportation. I had occasion to browse through the agencies' proposed text (warning: large file) yesterday and was startled to see that for purposes of calculating carmakers' fleet CO2 emission averages, it assumes that electric vehicles (EVs) and the electric usage of plug-in hybrids (PHEVs) have zero lifecycle emissions. Not only that, but the proposed regulation would count each EV as if it replaced two other emitting cars: thus, zero GHG impact not once but twice. Even the authors admit that this is false, and here I must quote,

"EPA recognizes that for each EV that is sold, in reality the total emissions off-set relative to the typical gasoline or diesel powered vehicle is not zero, as there is a corresponding increase in upstream CO2 emissions due to an increase in the requirements for electric utility generation. However, for the time frame of this proposed rule, EPA is also interested in promoting very advanced technologies such as EVs which offer the future promise of significant reductions in GHG emissions, in particular when coupled with a broader context which would include reductions from the electricity generation. For the California Paley 1 program, California assigned EVs a CO2 performance value of 130 g/mile, which was intended to represent the average CO2 emissions required to charge an EV using representative CO2 values for the California electric utility grid."

But while I appreciate the agencies' rationalization that EVs and PHEVs might be counted as having zero emissions on a purely temporary basis in order to provide incentives for carmakers to accelerate their introduction, I'm also painfully aware that other such "temporary" measures have persisted long after the original justification for them had become obsolete--and here I can't help but think of the ethanol blending credit that is now in its 31st year.

Why do these loopholes in the way we tally greenhouse gas emissions matter enough for me to hammer away at them like this? Consider the proposed vehicle rules. By ignoring emissions that occur outside these vehicles, the government is discouraging carmakers from using less exotic technologies that might actually deliver comparable savings of fuel and emissions sooner, and at a lower cost to taxpayers and consumers. A conventional Toyota Prius hybrid running on gasoline emits only 10% more grams of CO2 per mile than California claims for an EV powered by its greener-than-average state electricity mix. Since the same number of batteries could equip many more Prius-type hybrids, at a much lower cost per car than for a full EV, the benefits of rushing EVs into production seem much less compelling at this point, particularly when the government is also subsidizing the purchasers of EVs and PHEVs to the tune of many thousands of dollars per car. That will amount to billions of dollars of extra subsidies for an incremental emissions benefit that might just be negative for an EV recharged using coal-fired power.

"Start as you mean to go on," goes the old saying. We know that whatever their energy security benefits and general hi-tech niftiness, EVs are not zero-emission vehicles, just as we now understand that it is likely that burning corn ethanol releases roughly the same level of greenhouse gases as the gasoline it is intended to replace. If cap & trade bills such as Waxman-Markey and Kerry-Boxer are to have any integrity as tools for achieving genuine reductions in the global greenhouse gas emissions behind global climate change, then we must count all the emissions from all sources, no matter how politically unpalatable that may be. EPA and DOT might do well to heed this advice, too, before establishing a new, impossible-to-revoke entitlement for the manufacturers of electric vehicles.

Tuesday, October 27, 2009

Missing the Point on Energy and Jobs

I'm hardly suggesting that energy jobs are insignificant or inconsequential. I've spent my entire career in energy, and I recommend it without hesitation as a field in which one's contributions can have a measurable impact on society, often with better remuneration than in many other pursuits. The Oil & Natural Gas Industry Labor-Management Committee isn't wrong to stand up for the millions of industry-related jobs at stake in the current Congressional debate on energy industry tax benefits, any more than Wind Capital Group is to highlight the 2,500 jobs associated with the supply-chain effects of their Lost Creek Wind Project. But as important as preserving or expanding energy-related jobs appears today, it is even more essential for the long-term interests of the country that we not obsess about this one aspect of energy, to the detriment of others that will affect overall US employment and international competitiveness long after the unemployment rate has returned to its normal range.

Putting this into perspective requires recalling that by its nature energy is a capital-intensive business, rather than a labor-intensive one. One way to gauge that is to look at the labor productivity of energy companies. The latest annual report of my former employer, Chevron, reveals that on average in 2008 its 61,675 employees each accounted for $4.3 million of revenue, resulting in nearly $700,000 of pre-tax net income (after covering their own salaries and all other expenses.) In the utility sector, the comparable figures for FPL Group were $1.1 million and $137,000, respectively. Even a small, rapidly-growing renewable technology firm such as First Solar enjoyed revenue and pre-tax profit per employee in 2008 of approximately $354,000 and $132,000, respectively. With its high labor productivity, the primary employment impact of energy occurs where it is consumed, not where it's produced, because energy is such a crucial input for so many sectors and the sine qua non of more than a few.

When legislation like the Kerry-Boxer climate bill, which includes many provisions that would make energy more expensive for consumers and businesses, is marketed as a jobs bill it merits a skeptical reception. Stimulating jobs in the 6-10% of the economy devoted to energy seems unlikely to compensate for the loss of jobs that would ensue throughout the broader economy, if climate legislation caused energy costs to soar. That may, however, be a necessary evil, and the question we should really be asking is not how many green jobs such legislation will create, but whether on balance its provisions are truly justified in order to address climate change--even if they resulted in a net loss of employment, as I strongly suspect they would. Unless the answer is an unequivocal yes, we could be setting our long-term energy policy on the basis of a metric that is only a minor contributor to either energy costs or total economic activity, for reasons that seem unlikely to stand the test of time.

Friday, October 23, 2009

Sequestration and Education

The stakes are high. Despite recently losing some market share to natural gas and renewables, coal-fired power plants make up the single largest source of electricity in the US by a wide margin. In the 12 months through July, coal accounted for 46% of US power generation, compared with just 3% for non-hydro renewable energy. Short of simply shutting down every coal-fired power plant and leaving a gaping hole in our national electricity supply that the current generation of renewables can't yet fill, we need to find a way to control the emissions from coal directly. That's where CCS comes in. The coal power performance standards in Waxman-Markey and Kerry-Boxer would require that by no later than 2027 any new coal-fired power plants licensed after 1/1/09 must cut their net CO2 emissions by at least half. CCS looks like the only practical way of doing that--if you can call something that has been deployed so sparingly practical. But how can CCS be implemented if the public isn't willing to have CO2 stored underground anywhere?

CCS is new, but it's not so new that it hasn't already attracted pushback. Earlier this year Shell encountered significant opposition to injecting CO2 into a depleted gas field in the Netherlands. Meanwhile Vatenfall's project at Schwarze Pumpe in Germany is apparently venting its captured CO2 to the atmosphere, because the firm can't get a permit to inject it. "Not in My Ground", is how another article described opposition to carbon sequestration at an Ohio ethanol plant. My Google search even turned up a blog entitled, "Citizens Against CO2 Sequestration." Aside from the technical challenges associated with separating, transporting and injecting CO2 into geological storage sites, do these opponents have a scientific basis for being concerned about the health and safety risks? Perhaps, though an article on the subject cited by the Citizens Against blog that refers to the health hazards of drinking water mixed with CO2 had me rolling my eyes. Perhaps the author was unaware that hundreds of millions of us do that every day; we call it soda pop, and it's a big business.

Rather than dismissing all this as a simple case of uninformed NIMBYism (or as the Guardian newspaper in the UK referred to it, "numbyism", as in not under my back yard) I suspect it reflects a fundamental gap in the public's understanding of what lies beneath its feet. I simply cannot count the number of people I've encountered in the course of my long career in energy who were under the impression that oil was found as pools in giant underground caverns, rather than contained within tiny pores in solid rock strata. If most people so badly misunderstand the geological basis of a technology as established and commonplace as oil & gas drilling, how on earth can we expect them to have a coherent picture of what happens to CO2 when we pump it underground? Of course they're going to fear it could all come right back out and possibly asphyxiate them, in the manner of the volcanic CO2 seepage at Lake Nyos in Cameroon and elsewhere.

From my own perspective, the existence of enormous natural gas reservoirs--confusing terminology, perhaps--constitutes a sufficient proof of concept by demonstrating that gases can be stored safely underground for intervals as long as millions of years. If impermeable cap rock can seal in billions or trillions of cubic feet of methane, the molecular diameter of which is smaller than that of CO2, then once the CO2 is down there, the vast majority of it is going to stay there. But just as telling people that a flu vaccine is safe apparently leaves large numbers of them unconvinced, I conclude we need to invest a fair amount of time, attention and resources into educating the public about the science and safety of injecting CO2 under the ground, before we can base our national energy strategy on this technique.

Wednesday, October 21, 2009

The Weak Dollar

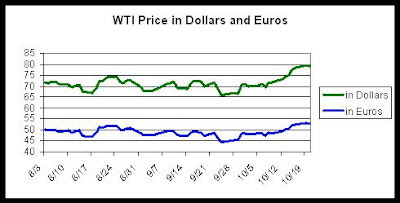

Having lived overseas and traveled extensively, I've been aware of exchange rates for most of my life. That's given me a clear perspective that the dollar isn't just weaker now than it was a few months ago or a couple of years ago, but has been deteriorating more-or-less steadily for a very long time. From my childhood I can recall when a dollar was worth roughly four Deutschmarks, and even my father's salary as a junior Army officer went pretty far on the local economy. As an adult I worked in Germany for a few months in the early 1980s, when a buck still bought more than 2 Marks. With the Deutschmark having been subsumed into the Euro, with its extremely short and volatile history, it's easy to lose sight of the dollar's gradual slippage, which has resulted in an equivalent Deutschmark/Dollar rate today of 1.30:1. Fully appreciating this trend requires examining the longer history of exchange rates between the dollar and more stable currencies such as the Deutschmark and the Swiss Franc, which is now trading at virtual parity with the greenback. It's not a pretty picture, and it has significant implications for a country with such large structural import requirements, not just for energy, but for so many other products.

While I'm not advocating a return to the gold standard or even necessarily dismissing the benefits that a weaker dollar has provided at times, I find the long and bumpy, but nevertheless steadily-downward slope of the dollar's value worrisome. Moreover, it's hard to see what could stem this trend in the near term, with the federal government committed out of necessity to holding short-term interest rates at essentially zero to avoid putting the economy back into a tailspin, while other countries still offer positive interest rates and some have even raised them slightly. Nor do trillion-dollar fiscal deficits seem conducive to a stronger dollar any time soon. What would dollar-denominated oil prices do if the dollar continued to fall past $1.50 per Euro toward the 2:1 level, all other things being equal? $100/bbl probably isn't a bad guess, along with everything else that goes with it.

Monday, October 19, 2009

"Feeding Frenzy"

As recently as a couple of years ago, few energy companies were enthusiastic about the prospect of cap & trade, because it was bound to raise their costs and reduce demand for their output, at least from energy sources with substantial emissions of CO2 and other greenhouse gases. If the bill passed by the House had treated all emissions from all sectors equally--a level playing field--we'd still see visionary companies diverging from the industry's stance, but their numbers would probably be a lot fewer for the simple reason that there wouldn't be nearly as much financial gain in it for them. When no-nonsense companies like Exelon and several of its utility peers break ranks with the US Chamber of Commerce on this issue, it's a good bet that they see a direct strategic advantage that will put money in their shareholders' pockets. Simply put, this is as good a deal as they're going to get. But while I find their support of cap and trade perfectly rational and even laudable, it should by no means be read as a sign that the Waxman-Markey approach is the best means of addressing climate change.

As I've noted in previous postings, Waxman-Markey was excessively generous in handing out emission allowances to the electricity sector, at the expense of the transportation sector. It also lavished allowances on non-emitting sectors and favored causes and groups in lieu of cash--a form of largess that fundamentally undermines the accountability of these benefits, because no one knows or can know what they will be worth when they are eventually received. Yet although this is bad policy on many levels, I see many people holding their noses and supporting the W-M approach, because they conclude that once the free allocations have phased out in 2030, we'll be left with a more or less pure cap & trade system enforcing a steadily tightening cap on emissions. The problems with this thinking lie in the enormous distortions and unnecessary economic hardship those uneven allocations will create over the next 20-plus years and the opportunity cost of the emissions reductions that could have been achieved more quickly and cheaply.

My strong preference has been for an even-handed cap & trade system that would include the broadest possible collection of emissions sources, providing great diversity of abatement costs and thus great scope for emissions trading to minimize the cost of achieving our emission reduction goals, and with most of the proceeds rebated directly from the government to taxpayers. Unfortunately, the ship has sailed on that approach--at least for now--and anyone supporting cap & trade for the elegant simplicity of its mechanism for squeezing out emissions is left hoping that the legislative excesses of one chamber of Congress will cancel out those of the other, and that somehow two bad bills will beget a good one.

Thursday, October 15, 2009

Regulating EV Recharging

The discussion with the PUC hinges on some very thorny questions: Is a company that buys electricity for resale to consumers for the purpose of recharging electric vehicles--which takes in both battery-electric vehicles and plug-in hybrids--more like a utility or a gasoline distributor or retailer? Who should pay for installing recharging facilities, and how--and from whom--should these parties recover their investment? Should a consumer who already uses large quantities of electricity at home and pays at the top rate tier, which can hit $0.40/kWh in some areas, qualify for discounted power to recharge an EV? How should a customer be billed when recharging outside the service area of the utility from which he normally buys power? The list of such questions is long, and looming behind them are larger questions about how best to gauge the effect of EV recharging on greenhouse gas emissions and air quality concerns, and to manage its impact on the regional generating mix, and on grid stability and reliability. Many EV advocates assume that EVs are inherently grid-stabilizing and renewable power-enabling, though it's not hard to construct scenarios in which the opposite could be equally true, if they're not implemented properly.

The emissions aspect becomes even more interesting in light of the views I saw expressed in a PUC filing by Tesla Motors, Inc., a Silicon Valley manufacturer of high-end electric sports cars that recently qualified for a half-billion dollars in low-interest expansion loans from the federal government. Tesla sees the generation of tradable credits under either cap & trade or the state's Low-Carbon Fuel Standard as a significant source of revenue for the owners of EV recharging facilities, and they might be right, though when I converted the federal estimates of emission allowance values under Waxman-Markey of around $15/ton of CO2 to cents per kilowatt-hour, using California's natural gas-dominated average generating mix, I came up with a value of less than a penny per kWh. I have to wonder how excited utilities will be to take on the cost and risk of putting in EV rechargers for such a small reward, if they can't also make a profit selling power to EV drivers.

The whole notion of regulating resellers of electricity to EVs as utilities also raises serious questions about the alternative business models now under consideration by companies such as Better Place. Would offering EV services on a cents-per-mile basis, rather than cents per kWh, be deemed sufficiently transparent, and would they have to negotiate their profit margins and investment recovery with the PUC? That sounds like a great way to make it harder for anyone new to the scene to compete with traditional utilities in this area.

Fairly soon the California PUC will resolve most of these questions and in the process largely define the environment in which EVs will emerge in the biggest early market for them in the US, potentially setting the standards for their use throughout the US and beyond. I don't have a horse in this race, but I will be watching the outcome with great interest.

Tuesday, October 13, 2009

The Necessity of "All of the Above"

This picture starts with our total primary energy consumption in 2008 of 99.3 quadrillion BTUs (quads.) Nearly three-fourths of our needs, or 73.7 quads, were produced domestically by a mix of 79% coal, oil and natural gas, 11.5% nuclear power, and a bit over 3% hydropower. Non-hydro renewables--the wind, solar, geothermal and biomass power plus biofuels that constitute the primary focus of US energy policy today--made up the remaining 6.5% of domestic energy production. Now add the 26% of US energy consumption supplied by imports, mainly crude oil and petroleum products, and we have the breakdown shown at the left hand edge of the graph. The rest of the picture is the result of a highly simplified set of assumptions based on phasing out fossil fuels and replacing them with the non-hydro renewables that have been growing so rapidly. It ignores such important considerations as reliability and intermittency, compatibility with infrastructure, and turnover of vehicle fleets.

According to the Energy Information Agency's data, while wind and solar power have been growing at roughly 30% per year each, the total renewables category has been growing at a somewhat slower pace, even after separating out hydropower, which has actually declined significantly since the 1990s. While the average growth rate for all the non-hydro renewables since 2000 has been around 4%, I've more than doubled this for the purposes of my projection to 10%. Renewables would do very well to sustain that kind of pace over the next 11 years, because the bigger they get, the more capital they will require each year to add the next year's increment of growth, and the more hurdles they will face, particularly from NIMBY or "energy sprawl" concerns. 10% compound growth would see these renewables more than triple by 2020, providing plenty of room for biomass/biofuels to double and for wind and solar to double several successive times.

I've also assumed a steady improvement in energy efficiency of 1% per year. If that doesn't sound impressive, compare it against a pre-recession trend of 1% annual growth supporting population growth of around 0.7% and economic growth of 2-3%. 1%/yr. would reduce total energy consumption by almost 12% by 2020, reflecting an improvement in BTUs/$GDP over this interval on the order of around 35%. A recent study by McKinsey & Co. indicated that if the US invested $500 billion in energy efficiency, we could cut our energy consumption by 23% by 2020, so my view is only a little more conservative, reflecting my experience that such things tend to take a bit longer than we expect.

As for nuclear, I think we'll do well to maintain the output of the existing fleet without seeing retirements outweigh additions in this timeframe. Most of the new plants now being discussed would probably only affect the last couple of years of this scenario, in any case.

The biggest impact in the graph above comes from my assumption that domestic fossil fuel production would fall by 5% per year. That will probably seem extreme to some and timid to others. It certainly looks extreme in the context of the recent surge in natural gas production and the stable output of US coal mines. Even US oil production has staged a bit of a comeback recently, thanks to successes in the portions of the Gulf of Mexico where drilling is allowed. However, in the absence of strong sustained rates of oil and gas drilling--drilling that requires both access to resources and a supportive regulatory climate, neither of which appears to be forthcoming--these successes will fade and the high intrinsic decline rates of the mature US hydrocarbon basins would take over. And with new coal-fired power plants being canceled and older ones facing tough competition from gas turbines and renewable power, along with restrictions on practices such as "mountaintop mining" and the prospect of either a Congressionally-mandated or EPA-imposed cap on emissions, a decline in coal output would accompany drops in oil and gas.

All of these growth and decline rates working together produce the picture above, showing fossil fuels tailing off faster than renewables can backfill for some time. That results in net US energy imports growing through 2016, then tapering off gradually as renewables finally gather momentum, but with us arriving at 2020 even less energy independent than we are today. That outcome explains my strong conviction that it is premature for us to give up on the valuable contribution of domestic oil and gas, particularly when we take into account the form that most of those growing energy imports is likely to take: imported oil. Naturally, this is just one scenario among many--though I'd argue it's likelier than some--and it illustrates that no single solution, neither renewables, nor efficiency, nor even greatly expanded drilling, is likely to be capable of delivering the energy we will need without increasing our vulnerability to foreign energy suppliers. They must all work together, if we're to make meaningful progress toward greater energy self-reliance.

Friday, October 09, 2009

Meme Watch: Peak Demand

Earlier this week, a friend shared a copy of a report from Deutsche Bank Global Markets Research describing their view of the future oil market shaped by coinciding--and related--peaks in global oil supply and demand. Unfortunately, the report doesn't seem to be available on DB's public website, though it was recently summarized on the Wall St. Journal's Environmental Capital blog. While I spotted several possible weak points in their analysis, they make a strong case that the combination of improved efficiency and the electrification of vehicles will result in the global demand for oil stalling and eventually falling, roughly around the same time many analysts expect global oil supplies to peak.

Perhaps I was predisposed to accept this logic. My presentation on the Alternative Energy panel of the recent IHS Herold Pacesetters Energy Conference included a graph highlighting the ongoing compression of US petroleum gasoline demand between falling motor fuel consumption and rising biofuels supplies, a topic that was subsequently reported in the Journal's "Heard on the Street" column. At that same conference I also heard the Managing Director of CERA's Global Oil Group describe his firm's rigorously researched view of an impending peak in global oil demand. Peak Demand can't easily be dismissed as a "fringe" theory, because it is based on a combination of hard data and thoughtful analysis and forecasting.

My purpose in mentioning Peak Demand now isn't to debate its merits in depth; that's a matter for another day. Rather, on the basis of my conviction that there's at least a reasonable case for such an outcome, I thought I'd spend a moment musing on the consequences of the proliferation of this meme in the marketplace of ideas related to energy. After all, the Peak Demand meme challenges two key pieces of conventional wisdom about oil, one or both of which are central to the rate at which Peak Oil (supply) might be approaching. First, it undermines the notion that once the US economy finds its way back to meaningful growth, oil demand will resume its former trajectory, which had seen gasoline demand growing by 1-2% per year and diesel demand growing at an even faster pace. With a major new emphasis on miles per gallon and the demise of the SUV fad, the fuel economy of the total US car fleet doesn't need to improve by very much each year to outpace our underlying population growth and a modest resurgence in vehicle miles traveled. Secondly, the same dynamic might even hold true for large developing markets, if electric vehicle demand grew rapidly enough, undermining the notion that whatever happens in the US and EU, oil demand from China and India constitute an unstoppable juggernaut.

With spare global oil production capacity effectively used up by 2007, the logic of Peak Oil helped to provide the narrative support for an oil market that ran up from the low $50s to $145 per barrel in the course of 18 months. How different might a future oil price spike be, if instead of a widely-shared view that oil was on the verge of becoming truly scarce--rather than merely expensive--there were an equally widely-held expectation that in the long run that scarcity might become irrelevant as a result of the demand for the commodity gradually unwinding of its own accord? Such dueling memes, together with painful memories of oil's collapse down to $33 last winter, might give some traders pause, before again buying into the notion that $100 oil would soon give way to $200, $300, or $500 per barrel.

Wednesday, October 07, 2009

Setting Ethanol Free

Consider the historical argument first. There's no doubt that without the subsidies provided by the federal government and various states over the last thirty-plus years, the ethanol industry would not have grown to a sufficient scale to take on the new challenge set for it by Congress in the EISA. From the landmark establishment of a $0.40/gal. excise tax exemption for ethanol blended into gasoline under the Energy Tax Act of 1978, it took the industry 14 years to grow to the 1 billion-gallon-per-year (BGY) mark (equivalent to 43,000 barrels per day of gasoline) and another decade to reach 2 BGY. When EISA was passed at the end of 2007, the industry was already producing around 6 BGY and had built enough capacity to produce nearly 8 BGY, or around 5.5% of US gasoline demand that year, by volume. That was already more than the 7.5 BGY required under the previous RFS established by the Energy Policy Act of 2005. But as ambitious as the goals of the newly-enacted RFS seemed in 2007, the industry continued building capacity at a rapid pace, and by the start of this year had enough ethanol plants built or under construction to satisfy 97% of the 15 billion gallon target (and ceiling) that Congress set for corn ethanol.

Two things seem clear from this history: First, the combination of a generous blenders' credit, which until the start of this year paid $0.51/gal., and two successive federal biofuel standards led to over-expansion of the ethanol industry relative to demand, either mandated or economic. That harmed the industry and led to many ethanol plants being sold or mothballed in the last year, with a number of ethanol companies going bankrupt, including VeraSun, which had been an industry leader not long before its demise. Other important factors certainly contributed to these business failures, including the spike in corn and oil prices in 2007 and 2008 and the sudden collapse of the latter last fall; however, the over-extension of these companies as they went deeper and deeper into debt to build new capacity left them particularly vulnerable to volatile commodity markets and the emerging credit crisis.

In addition, the above figures make it very plain that the US corn ethanol industry doesn't need to grow further, because it is already within striking distance of the target set by the government, which also appears to represent the maximum prudent level of output for a fuel source that makes such heavy use of water and fossil energy sources in its production, and that ultimately competes with the consumption of corn as food or feed, here and abroad. In other words, the work of the subsidies and mandates for corn ethanol is complete, and the government has shifted its focus to cellulosic ethanol and other advanced biofuels, which enjoy their own distinct--and more generous--subsidies. It hopes these sources will expand from essentially zero to cover the remaining 21 BGY of the current RFS by 2022.

The argument that corn ethanol is somehow entitled to perpetual subsidies on the basis of an inaccurate comparison to the tax benefits currently enjoyed by the oil & gas industry--tax benefits that are currently under threat, themselves--is equally unpersuasive. In the posting in which I recently examined the Treasury Department's arguments for dismantling those oil & gas tax benefits, I compared the level of incentives for conventional fuels with those provided to ethanol. That $0.45/gal. ethanol blenders' credit swells to the equivalent of about $0.77/gal. after accounting for the lower energy content of ethanol. That compares to incentives of around $0.12/gal. for US oil production. And that doesn't even take into consideration the fact that producing a gallon of ethanol requires much more energy from other sources, such as natural gas, than producing a gallon of crude oil or gasoline. Thus ethanol receives at least six times the subsidy per delivered BTU that domestic oil does, even though their energy security benefits per gallon are identical.

The GAO report estimates the cost to the Treasury of the ethanol blenders' credit at $4 billion last year, growing to $6.75 billion by 2015, if not sooner. Although at a time of trillion-dollar deficits that may look no more significant than a rounding error in the government's books, continuing this outdated and unnecessary incentive sends a bad message to the developers of other, less mature alternative energy sources. It tells them that they don't need to worry so much about making their technologies competitive with conventional energy, because the government is likely to subsidize them until the end of time--or until the Treasury runs out of money, a date that will surely arrive faster, the more unnecessary subsidies it hands out. After having been extended by last year's Farm Bill, the present Volumetric Ethanol Excise Tax Credit and the tariff on imported ethanol that mirrors it are due to expire at the end of next year. After 30 years of assistance--spanning my entire career in energy--it's time to find out whether this industry can survive and compete on its own.

Monday, October 05, 2009

Gasoline Stimulus Update

The fact that average US gas prices topped out at only $2.69/gal. this year, far below last year's peak of $4.11/gal., was mainly a reflection of the weakness of the global economy. US gasoline demand through July was running at around 1% below the same period a year earlier, on top of 2008's roughly 3% drop. Together with very weak diesel demand, that also contributed to much lower refining margins this year, compared to the last couple years. However, even if refining margins averaged zero for the rest of this year, it would take a crude oil price drop on the order of $15/bbl to send gasoline prices below $2/gal., where they were last Thanksgiving. And we'd probably have to see oil down around $40/bbl to end the year close to the $1.61/gal. reported last December 29.

As I noted early in the year, although this gasoline stimulus was helpful while the federal stimulus effort was gearing up, it was always going to be short-lived. And just like the fiscal stimulus, we'll never know how many jobs it saved or helped create, though it's clear that we'd have been much worse off had this year's gas prices reprised their 2008 levels.

Friday, October 02, 2009

No Good Choices

With regard to the Kerry-Boxer bill, designated as the "Clean Energy Jobs and American Power Act"--no catchy "ACES" acronym there--I haven't had time to wade through its 801 pages, so I'll keep my comments brief. Contrary to the conclusion reached by the editors of the Washington Post, the bill does include a cap & trade mechanism for greenhouse gas emissions, though I can understand why they might not have looked for it under the obscure rubric of "Pollution Reduction and Investment Program". From my quick scan of that section, it strongly resembles the cap & trade aspects of Waxman-Markey, with the crucial difference that the allocation of emission allowances among various sectors has been left to other Senate committees to fill in. The only allocation clearly specified is that 25% of allowances should be auctioned, with the proceeds to go toward deficit reduction. As laudable as that sounds, I would merely note that every dollar raised by cap & trade that is not returned to taxpayers constitutes a new tax by another name and should be counted in the total tax burden on the productive economy.

Now let's turn to the EPA announcement, which has me even more concerned. Last week I received an emailed article from the Institute for Policy Integrity at NYU suggesting that under the Clean Air Act the EPA could create its own cap & trade system for greenhouse gases without requiring additional authorizing legislation. That briefly buoyed my hopes for a more pristine version of cap & trade, without the unseemly scramble to siphon off its proceeds to fund every pet project and cause of every Member or Senator whose vote was needed to pass the thing. Then I read Administrator Jackson's remarks describing the approach she has in mind, and I knew the EPA was applying its old pollution-abatement mentality to climate change, facilitiated by a Supreme Court ruling that unhelpfully labeled CO2 and other GHGs as pollutants. The new rule would impose New Source Review criteria on the greenhouse emissions from power plants, refineries and factories when they expand or modernize, and it parallels the Best Available Control Technology requirement that is at least logical for local air pollutants like SOx and NOx that result from fuel impurities and combustion byproducts, but that makes little sense when dealing with the results of the primary chemical reaction of combustion: C + O2 --> CO2.

With all due respect to Administrator Jackson, a fellow chemical engineer who I'm sure understands the technical side of this issue as well as I do, her remarks betray a deep misunderstanding of the economic consequences of regulating carbon this way. The key phrase in her comments, which focused on minimizing the impact on the small businesses she seeks to exclude from this ruling was, "...all without placing an undue burden on the businesses that make up the better part of our economy," as if that "better part" didn't consume the electricity, fuels and raw materials produced by the part she proposes to regulate--presumably the "worst part" of our economy. The reality is that the costs imposed on large emitters will inevitably fall on those same small businesses when they pay their utility bills, buy fuel and other inputs, and when they seek to sell to consumers and other businesses equally burdened by these new, higher energy costs.

There is simply no getting around the fact that regulating greenhouse gas emissions, which amounts to charging a fee for something that has been free since the discovery of fire, is going to impose a burden on the entire economy. The principle behind cap & trade is the effort to make that burden as small as possible, by encouraging those parties with the lowest costs of emissions abatement to make the biggest cuts. Industrial emissions reductions are inherently more expensive than those in many other sectors, and we need a solution that unleashes the cheapest CO2 cuts, instead of forcing the most expensive ones to be done first.

I haven't given up entirely on the hope that the final outcome from the Senate might restore some sanity to the cap & trade provisions that Messrs. Waxman and Markey so deftly used to co-opt the biggest emitters into supporters, as we've seen with the recent fracturing of the US Chamber of Commerce on this issue. Utilities like Exelon, PG&E, and PNM Resources must realize that they are unlikely to get a better deal on emissions than under Waxman-Markey, and I don't blame them for advancing their interests. But that doesn't make this the best solution for the economy, or more importantly the best way to go about reducing the emissions responsible for humanity's contribution to climate change. And if the White House needs the threat of new EPA rules to have at least one flag to wave at the global climate conference in Copenhagen in December, in case the Congress fails to pass a Waxman-Markey/Kerry-Boxer hybrid by then, I understand that, too. However, that doesn't justify actually implementing those regulations and making the task of reducing our emissions harder and more costly.